S’pore dollar slips as trade war chips at monetary band

Published on: Monday, May 20, 2019

TOKYO: The Singapore dollar is poised to weaken further as the escalating trade war between the world’s two largest economies weighs down growth in the export-dependent city-state.

Poor export data that landed Friday underscore the downward pressure on the currency’s nominal effective exchange rate, which has quietly crept away from the upper end of the band that monetary policymakers use to keep Singapore on an even keel.

ADVERTISEMENT

With no deal in sight between the US and China, revised gross domestic product figures due Tuesday are the next thing to watch for clues on the trajectory of the Singapore dollar, which has slipped about 1pc this month.

“Given the small size of the Singapore economy and the subdued outlook in the electronic sector, risk is for more weak economic data to come,” said Frances Cheung, Head of Asia Macro Strategy at Westpac Banking Corp.

“Potentially weak data may push MAS expectations toward a more dovish side.”

ADVERTISEMENT

Larger declines in other Asian currencies caught in the crossfire between China and the US has deflected attention from the simmering signs of weakness in the Singapore dollar. A closer look shows that six-month forward discounts on the greenback against the currency narrowed to the tightest level in 16 months last week.

The Singapore dollar fell 0.2pc against to trade at S$1.3749 per US dollar as of 3.58pm local time on Friday.

ADVERTISEMENT

The International Monetary Fund warns that the risks to the economy are tilted to the downside and that the Monetary Authority of Singapore’s response to the challenge should be “data dependent.”

Analysts forecast a modest upward revision in first-quarter GDP growth to 1.5pc, which would still leave it far below the five-year average of 2.9pc and offer little support for the currency.

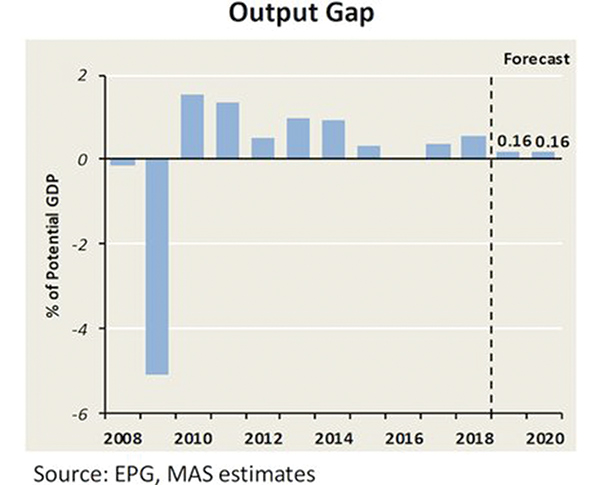

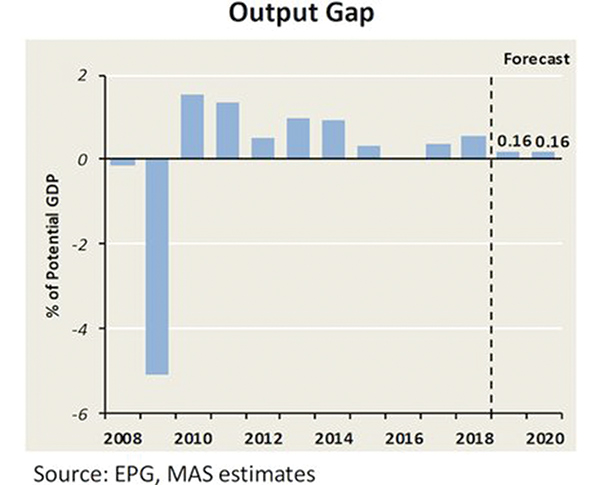

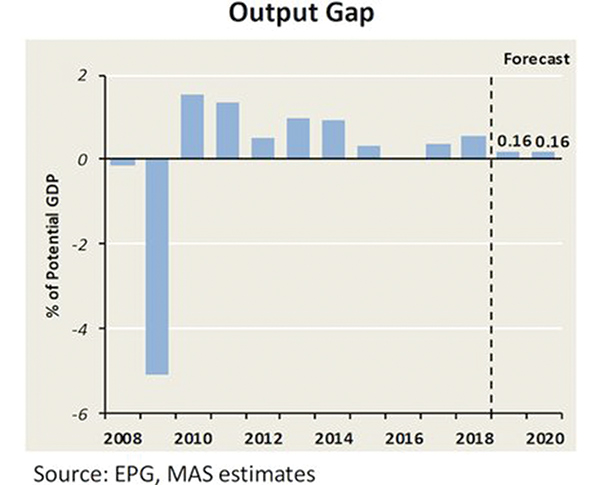

Looking beyond Tuesday’s data, a projected narrowing in the so-called output gap this year is also likely to keep inflationary pressures in check and weigh on the Singapore dollar.

Stay up-to-date by following Daily Express’s Telegram channel.

Daily Express Malaysia