Reliance selling stake to Aramco for US$75b

Published on: Wednesday, August 14, 2019

NEW DELHI: Saudi Aramco continued its push into Asian oil refining with an agreement to buy a 20pc stake in Reliance Industries Ltd’s oil-to-chemicals division at an enterprise value of US$75bil.

The deal, announced by Reliance Chairman Mukesh Ambani at the company’s AGM in Mumbai, is the biggest foreign investment in the company’s history and covers all of Reliance’s refining and petrochemical operations, including the Jamnagar refinery, the world’s biggest.

ADVERTISEMENT

Aramco, the world’s biggest crude exporter, would also supply the refinery with 500, 000 barrels of oil a day on a long-term basis, Ambani said.

The deal is subject to due diligence, definitive agreements and regulatory and other approvals, Ambani said.

Middle Eastern oil giants like Aramco have been expanding into downstream operations as they seek to move from being pure producers to becoming more integrated energy companies.

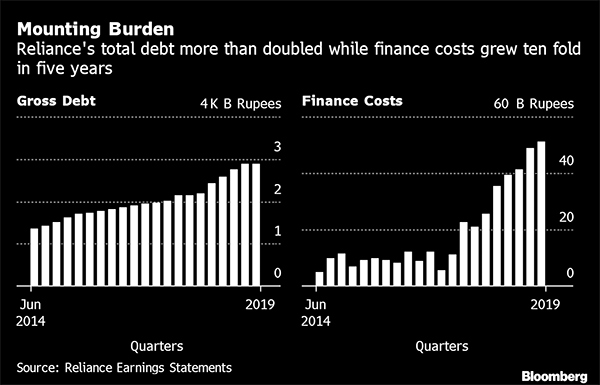

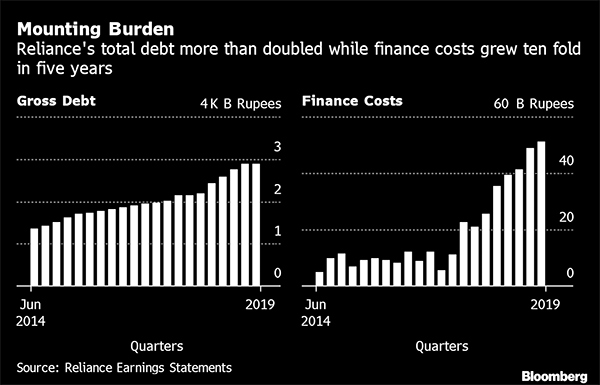

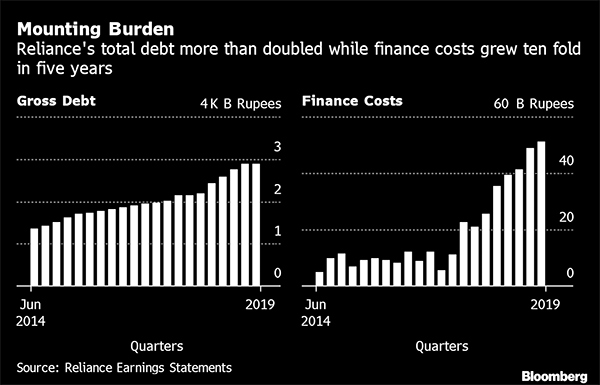

Reliance’s debt has risen over the past few years, as the Indian conglomerate poured money into new sectors such as telecommunications, and stood at US$32bil at the end of December, data compiled by Bloomberg show.

ADVERTISEMENT

Ambani, Asia’s richest man, met with Saudi Energy Minister Khalid Al-Falih in December to discuss opportunities for joint investments in petrochemical, refining and communications projects, according to a tweet from the latter at the time.

Aramco has been targeting refining deals in India since at least last year, when Chief Executive Officer Amin Nasser told reporters that the firm wanted to double capacity to produce gasoline and other fuels.

ADVERTISEMENT

Meanwhile, Reliance soared the most in more than two years after Ambani revealed a plan to sell a stake to Aramco as part of efforts to pare debt that piled after racking up $76 billion in capital expenditure in the last five years.

The conglomerate aims to be a zero-net-debt company in 18 months, Asia’s richest man told shareholders Monday.

Aiding that effort would be a proposed sale of 20pc of Reliance’s oil-to-chemicals business to Saudi Arabian Oil Co. at an enterprise value of $75 billion. The company will also start preparing to list its retail and telecommunications units within five years, Ambani said.

Shares of Reliance jumped as much as 8.8pc in Mumbai, the biggest intraday gain since Feb. 22, 2017.

The tycoon is cleaning up the group’s finances following years of spending on his wireless carrier, whose entry in 2016 with free calls and cheap data upended the industry and spurred a consolidation.

The $50 billion plowed into the phone venture, mostly in debt, has raised concerns among analysts including at Credit Suisse Group AG that Reliance’s ballooning borrowings could weigh on growth. Ambani sought to allay those fears.

“With these initiatives, I have no doubt that your company will have one of the strongest balance sheets in the world, ” he said. “We will also evaluate value unlocking options for our real estate and financial investments.”

The Aramco deal should be completed by March and is subject to due diligence, definitive agreements and regulatory and other approvals, Ambani said. He didn’t say how the deal would be structured.

Saudi Aramco and Reliance Industries have agreed to a non-binding Letter of Intent regarding a proposed investment in the Indian company’s oil-to-chemicals division comprising the refining, petrochemicals and fuels marketing businesses, according to a statement from Reliance on Monday.

Signalling an end to the spending cycle at Reliance Jio Infocomm Ltd., Ambani is setting a new growth path for his group, whose bread-and-butter business has been oil refining and petrochemicals. The company is building an e-commerce platform by leveraging its phone network and Reliance Retail Ltd. to eventually take on Amazon.com Inc. and Walmart Inc.

“This is a unique business model we are building in partnership with millions of small merchants” and mom-and-pop stores, he said. As part of the plan, Reliance has been forming partnerships and acquiring technology assets.

This month, Reliance announced plans for a joint venture with Tiffany & Co. to open stores for the jeweller in India, and in May paid $82 million for the British toy-store chain Hamleys.

The new businesses are likely to contribute 50pc of Reliance’s earnings in a few years, from about 32pc, Ambani said.

While the spending on Jio has helped Reliance lure almost 350 million users in the world’s second-biggest mobile market, the growth has come at a price.

Reliance had a net debt of 1.54 trillion rupees ($22 billion) at the end of March 31, according to Ambani. His plan to carry zero debt would mean the borrowings would fall below the company’s cash reserves, a level not seen since 2013.

Last week, Credit Suisse cut its recommendation for Reliance’s stock and the price target citing reasons including rising liabilities and finance costs. Shares of the company have slumped about 18pc from a record reached on May 3, compared with a 3.6pc decline in the benchmark S&P BSE Sensex.

Reliance’s debt is backed by “extremely valuable assets, ” Ambani said, signalling his group isn’t prone to the kind of troubles that have been plaguing many other corporate borrowers in India.

The conglomerate controlled by Ambani’s younger brother, Anil, has been struggling to pay creditors while his mobile carrier has slipped into bankruptcy.

Apart from the Aramco deal, Reliance also announced a joint venture with BP Plc this month, under which the European oil major would buy 49pc of the Indian firm’s petroleum retailing business. Reliance would receive about 70 billion rupees under this deal.

The “commitments” from the Aramco and BP deals alone are about 1.1 trillion rupees, Ambani said, adding that Reliance will induct “leading global partners” in telecom and retail units in the next few quarters. Some of the planned offerings revealed by Ambani:

A new broadband service called Jiofiber will start commercial services from Sept. 5 and will be available at tariff packs starting as low as 700 rupees a month with a minimum speed of 100 Mbps.

After mobile broadband, Jio to start generating revenues from Internet of Things and broadband for home, businesses and smaller enterprises by March 2020

Stay up-to-date by following Daily Express’s Telegram channel.

Daily Express Malaysia