Rivalry to intensify among O&G players

Published on: Wednesday, May 27, 2020

By: The Star

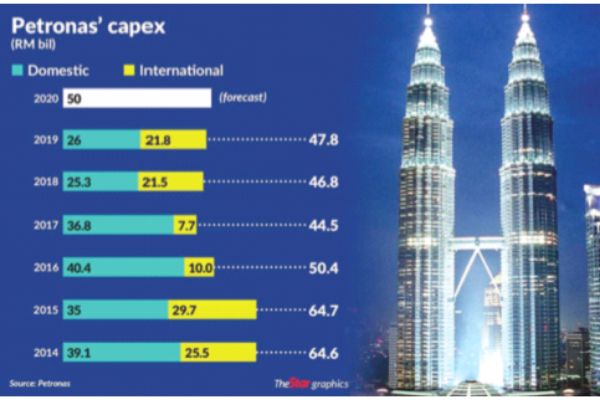

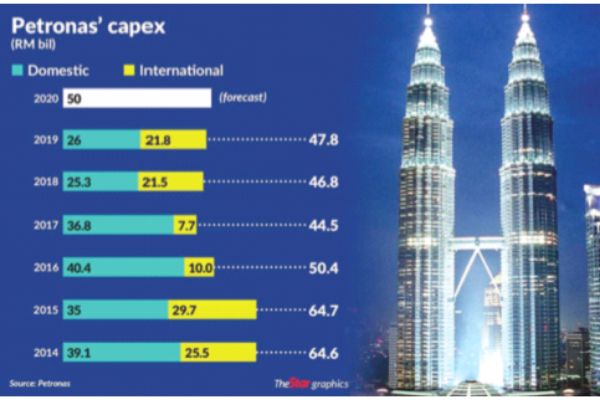

Petronas allocated RM50bil for capex this year, out of which RM26bil to RM28bil are for activities in Malaysia.

Petronas allocated RM50bil for capex this year, out of which RM26bil to RM28bil are for activities in Malaysia.

PETALING JAYA: The cake for domestic oil and gas (O&G) players has become smaller this year amidst the global economic turmoil that has led to Petroliam Nasional Bhd (Petronas) slashing its capital expenditure (capex) and operating expenditure (opex).This has upped the competition among some 4,000 service providers in Malaysia as the national oil company planned to reduce its capex by 21pc and opex by 12pc.

ADVERTISEMENT

Petronas allocated RM50bil for capex this year, out of which RM26bil to RM28bil are for activities in Malaysia.

While the group did not provide guidance for its opex, it is usually in the region of RM20bil, taking into account its selling and distribution expenses, administration expenses and other expenses.

This was RM22.66bil last year and RM21.72bil in 2018.

President and Group Chief Executive Officer Tan Sri Wan Zulkiflee Wan Ariffin said in a video message that the group will “strive as far as practically possible” to minimise the impact to its domestic capex programme.

ADVERTISEMENT

Taking the more conservative view, analysts are of the opinion that what the market forces failed to achieve in 2015 and 2016 during the previous oil price rout, that is a consolidation in the sector in Malaysia, may very well happen this year.

JF Apex Securities Analyst Lee Cherng Wee said the slash in capex meant fewer jobs and contracts for local players, with lower margins to those that win the projects.

ADVERTISEMENT

“The industry remains challenging until the oil price recovers and stabilises, Lee said.“Until then, major oil companies will be cautious and unwilling to invest capex until there is stability, ” he said.

An analyst said unlike any other oil price routs that Malaysia has been through, the one this year was something unusual which hit both ways in terms of supply and demand due to the economic standstill triggered by the coronavirus (Covid-19) pandemic.

The current situation would see inherently weaker companies fizzle out. And for those that would be getting their share of the cake, they could be expecting mediocre earnings.

“There are naturally fewer contracts and more delays in low oil price environments. Margins will definitely be compressed as producers are more cost conscious.

“We expect offshore support vessel (OSV) companies to take the heaviest beating due to the capex cut, ” he said.

The OSV players may have foreseen this, which was why it floated an idea to Petronas recently to set up a special purpose vehicle (SPV) to takeover the assets of ailing O&G companies.

According to reports, the Malaysia Offshore Support Vessel Association (Mosva) floated the idea to hasten the consolidation process within the industry. The fear is many may not survive the turmoil that the O&G industry is going through now.

There has yet to be any indication if Petronas would give the proposal any serious consideration but consolidation has been something the national oil giant has been pushing for since 2015.

The Brent crude oil price plunged from US$110 in 2014 to US$30 in 2016. No major consolidation took place as industry players opted for restructuring and recapitalisation, which left the industry as crowded as it is domestically.

Petronas is not the only major oil company to reduce its spending plans this year as cuts were earlier announced by other oil producing giants such as Saudi Aramco, ExxonMobil and Royal Dutch Shell, which added up to a combined US$38bil, equivalent to a 22pc decline from the initial spending plans of US$175bil to cope with the disruption brought by Covid-19.

Wan Zulkiflee had said that the industry has been badly affected by the unprecedented twin shock of both supply and demand.

“The markets were faced with a supply glut, triggered by the failure of the Opec+ to come to an agreement in early March and a subsequent oil price war.

“Demand plunged due to the sudden drop in economic activities, following global lockdowns caused by Covid-19, ” he said in the video.

Petronas announced its results for the first quarter this year (1Q20) on Friday, which saw its profit for the period plunging 68pc year-on-year from RM14.25bil to RM4.52bil, due to asset impairment and lower prices of LNG, petroleum products and crude oil.

Excluding impairment charges, its profit totaled RM9.19bil.

Its revenue only declined by 3.87pc y-o-y from RM61.99bil to RM59.59bil due to the impact of lower average realised price for LNG, petroleum products and crude oil and condensates.

On its prospects for the financial year, the group said in its quarterly report that while it continued to invest domestically, it anticipated constraints in the supply chain due to the ongoing pandemic.Stay up-to-date by following Daily Express’s Telegram channel.

Daily Express Malaysia